Hey there! If you’re running — or thinking about running — pay-per-call (PPCall) debt settlement campaigns, this guide is going to be your new playbook.

We’ve been at this for 8+ years, running our own media buying team and working closely with hundreds of affiliates. The good news? Debt settlement affiliate marketing is still one of the top-performing verticals in 2025. And we’re here to break down what’s working right now.

Why Debt Settlement?

Let’s start with the basics. Debt settlement helps people struggling with credit card or unsecured debt reduce what they owe—sometimes by 40–50%. A licensed company negotiates with banks and credit card providers, and clients pay a reduced amount through a dedicated account.It’s not a loan—just a smarter way out of financial stress.

This makes it a perfect offer for affiliates working in financial lead generation, especially if you're focused on high-intent inbound calls.

Who’s the Target Audience?

We’re seeing the best results with:- People aged 30–55

- U.S. residents with $10,000+ in unsecured debt

- Households with low-income (but not 0$)

- Both English and Spanish speakers

Understanding the Consumer Flow in Debt Settlement Pay-Per-Call Offers

The typical consumer journey for debt settlement services looks something like this:1. Ad Exposure. The consumer sees an ad online—on platforms like Facebook, Google, TikTok, or YouTube. This is where the affiliate grabs their attention.

2. Clicking to the Landing Page. Instead of directing consumers straight to a phone call from the ad (which usually doesn’t perform well), we recommend sending them to a landing page. This way, the consumer can learn more about the program and its benefits.

3. Call or Lead Form. On the landing page, the consumer is presented with two options:

- Call the phone number directly for the pay-per-call offer

- Submit a lead form (if the offer is lead-based instead of pay-per-call). We mostly run pay-per-call offers because it provides better high-intent leads for the advertiser.

5. Enrollment and Payment. If the consumer agrees to the terms, they enroll in the program, begin making payments, and start working toward getting out of debt. The typical duration of the program ranges from 6 to 24 months, but in some cases, it can take up to 48 months.

6. The Cycle Repeats. Unfortunately, some individuals fall back into debt after completing the program, starting the cycle over again.

Why Promote Debt Settlement Pay-Per-Call Offers?

Here’s why our affiliate marketers love this niche:Solid payouts (weekly):

- English calls: $55–$60 per qualified call (90+ sec)

- Spanish calls: $50–$55 per qualified call (90+ sec)

- Average RPC (Revenue per Connected Call) - $15-$25

Evergreen market: People always have debt. The need never goes out of style.

Great for scaling: With the right setup, it’s super scalable on both Facebook and TikTok — two of the top debt settlement traffic sources for affiliates today.

However, we have specific requirements for this kind of offers:

- geo restrictions (almost nationwide except few states)

- restrictions of debt amount (at least $10k - $15k)

- hours of operation (usually it's Monday to Friday or Monday to Saturday from 9 a.m. to 9-7 p.m. Eastern time)

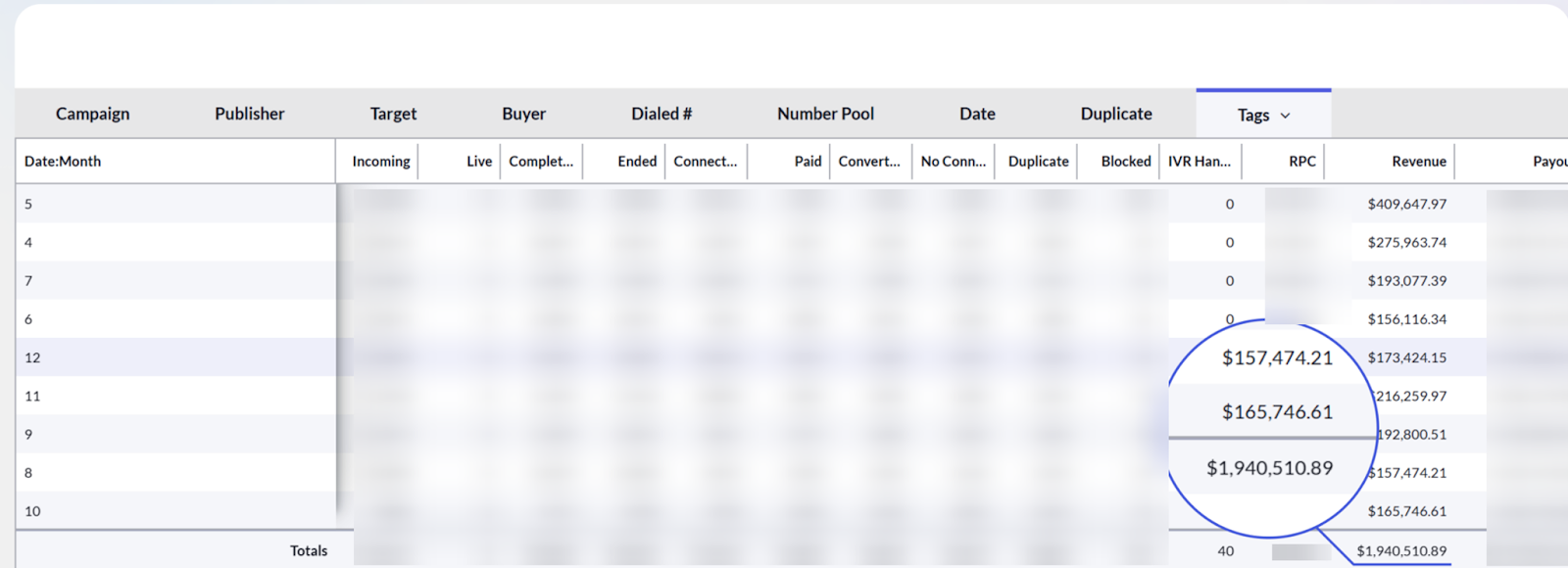

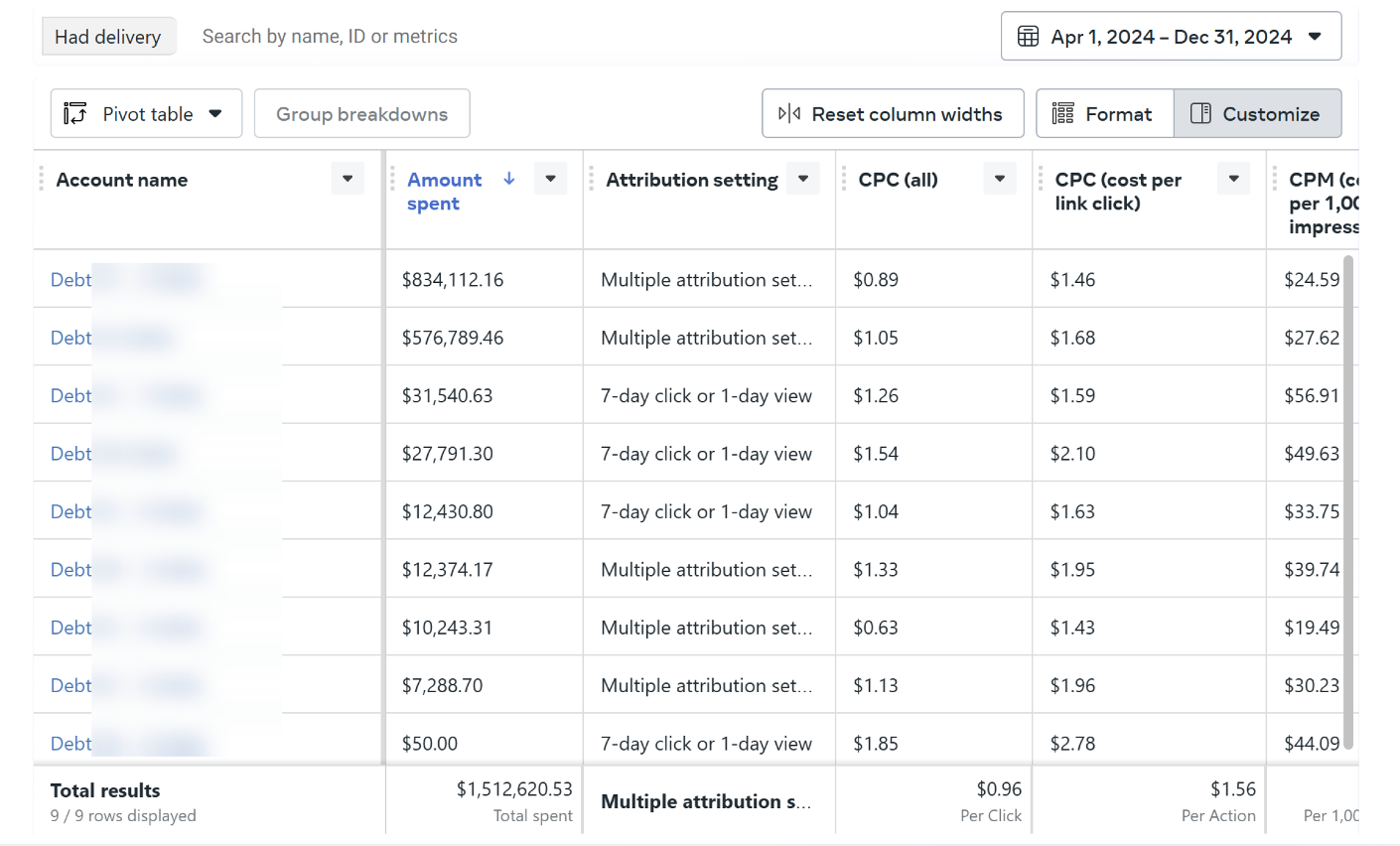

Real Results: Our Internal Facebook Campaign

From April to December 2024, one of our in-house media buyers spent $1.5M on Facebook and made $1.9M—a strong 20% ROI in a white-hat vertical.

We used around 9 ad accounts with 1 media buyer. Since this is a white-hat niche we didn't see any account disapprovals with Facebook.

TikTok is also super promising—but trickier to run (more restrictions, higher ROI). Both platforms are great for generating debt settlement leads, especially if you're focused on longer call durations and high retention rates.

Campaign Structure & Setup (What’s Working)

We keep it simple:- 1 Campaign → 10 Ad Sets → 1 Creative

- Lifetime budget (we set up campaign for the next 5-6 days and we set up the budget to be able to scale on specific campaign)

- All targeting is broad (required for special ad category)

- All ad sets use the same creative to find the best-performing ad sets

- Once we know what works, we scale those and kill the rest

Creatives That Convert

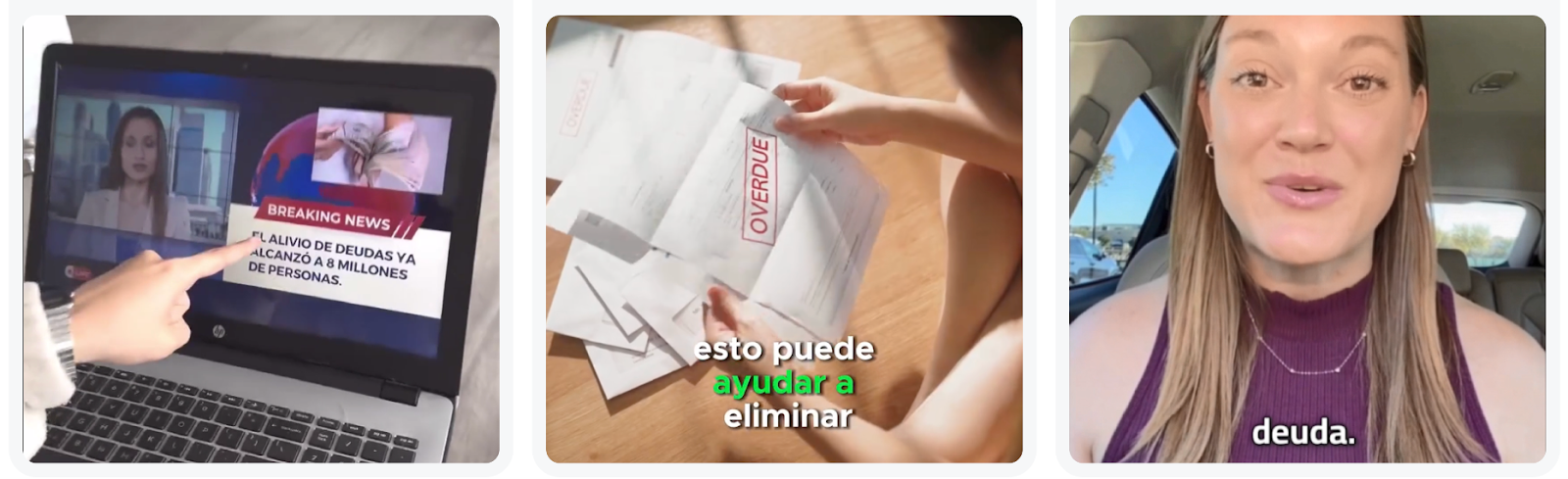

In this game, creatives make or break your ROI. Here’s what’s killing it for us:- News-style videos (in both English & Spanish). See English example here and here, and Spanish example here.

- B-roll with voiceover + subtitles (stock/YouTube/TikTok videos with voiceover from a real person or AI). Spanish example here

- UGC (user-generated content) from real actors or AI avatars. Example 1, example 2, example 3 (in Spanish).

Some notes:

- AI videos: ~$10 each

- UGC actors: $100–$200/video

- No static images—video is king

If you’re trying to improve your debt settlement call conversion rate, these creative formats will help increase quality and engagement.

Landing Pages: Keep It Straightforward

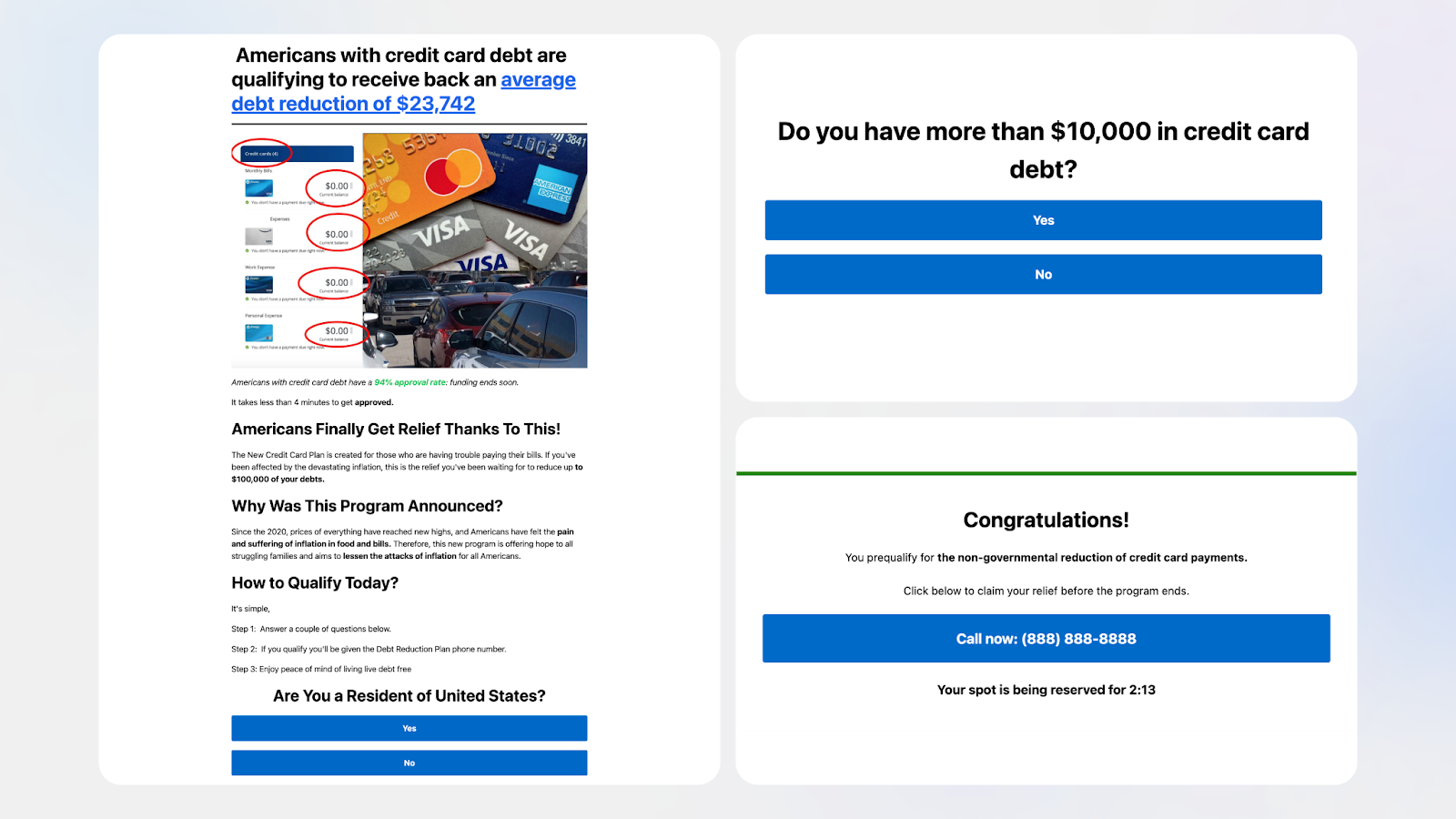

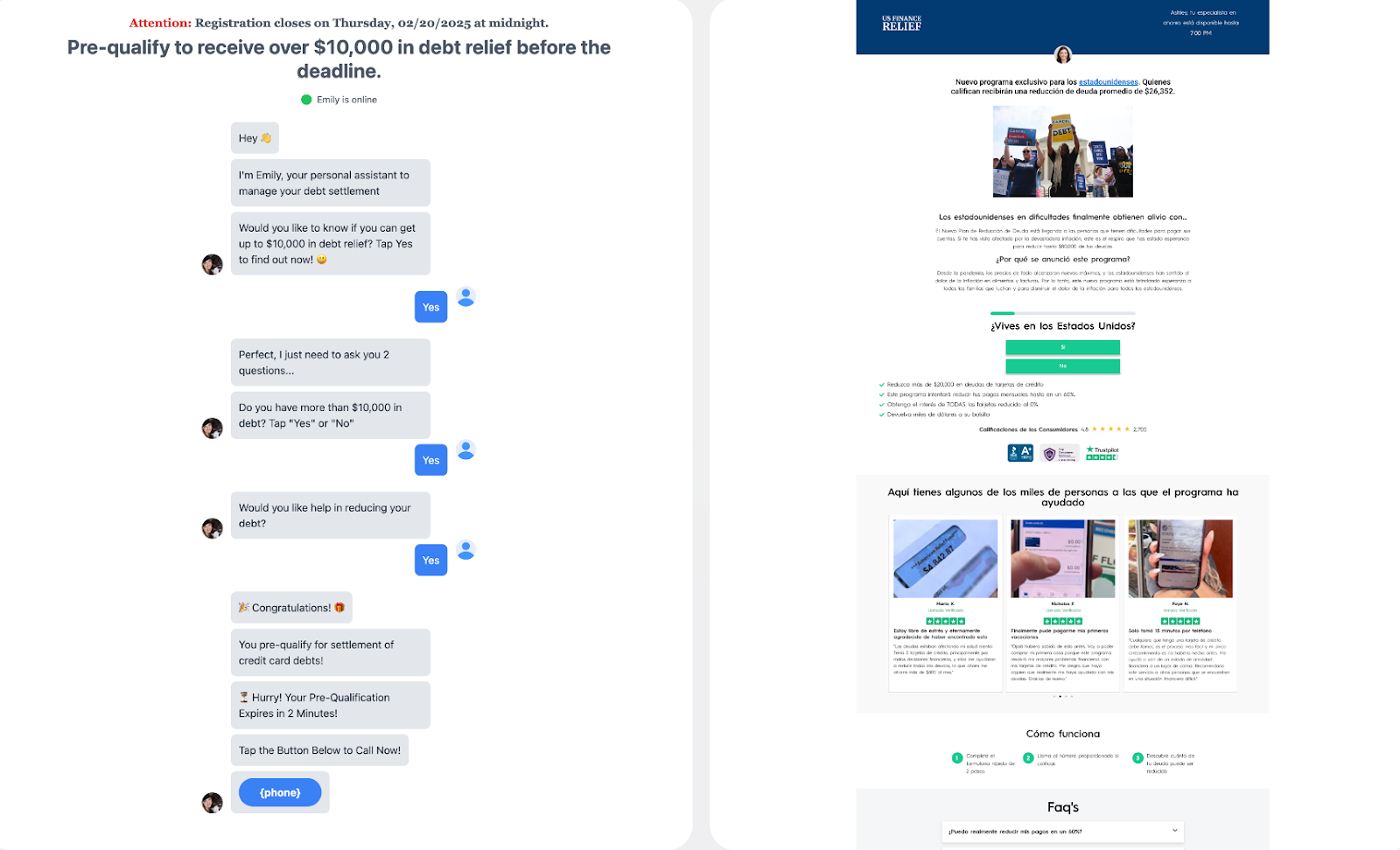

Want to know how to build landing pages for debt relief PPCall? This is it. We’ve tested a bunch, and these 3 types perform best:- Advertorial + quiz → our top performer

- Chatbot-style flow

- Quiz-only page

- Ask if they live in the U.S. and have over $10k in debt

- If yes → show phone number

- If they call and stay on for 90+ seconds → you get paid

Once your funnel works, you barely have to touch it—just rotate creatives and keep scaling.

Pixel Set Up & Funnel Tracking

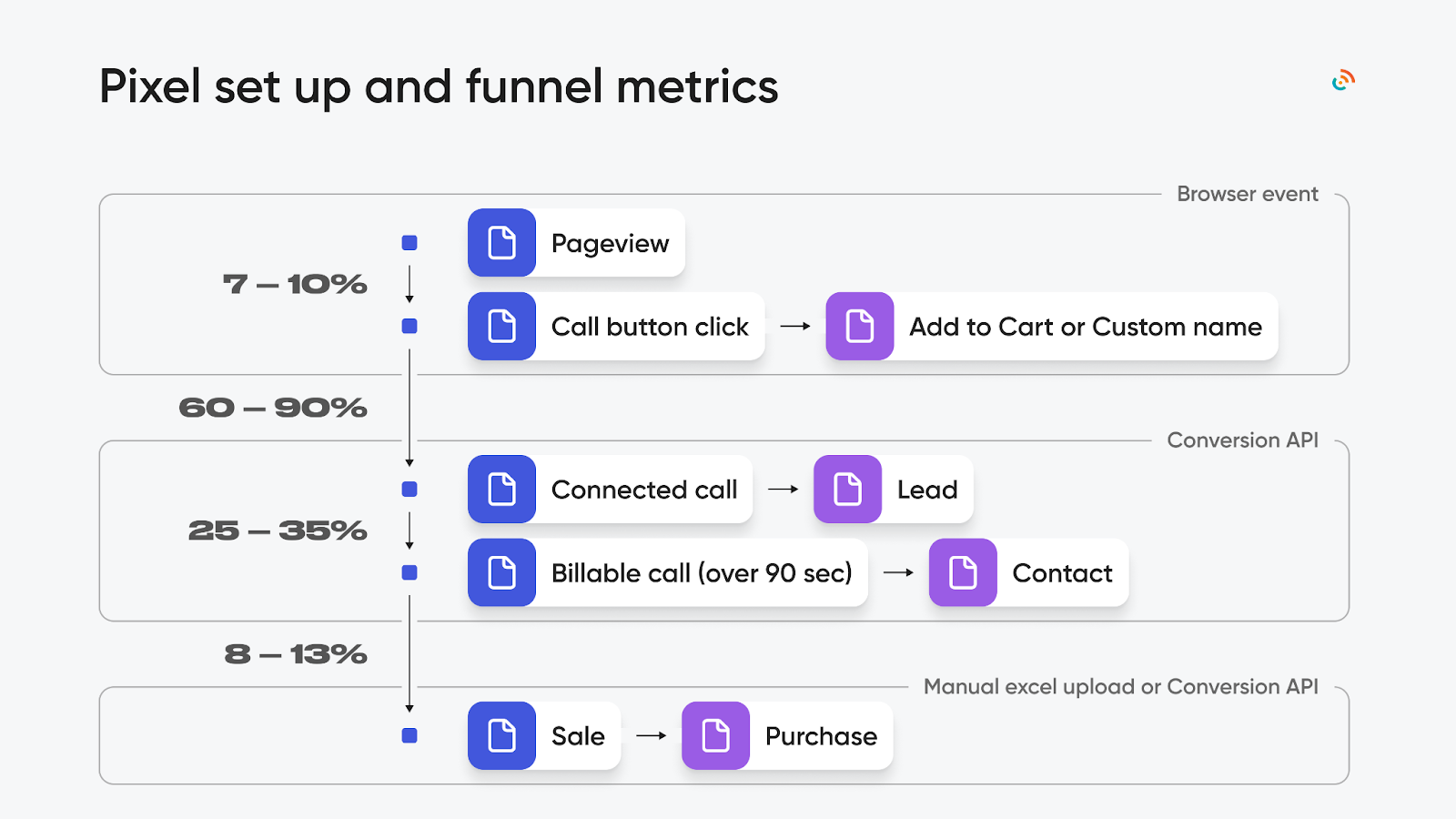

So now let's talk about the pixel setup since a lot of affiliates ask us about this.There are two types of events we pass - browser events & conversion API events.

Browser events

- Pageview

- Call button click (we pass this event as Add to Cart or Custom name)

Conversion API events

- Connected calls (we pass them as a Lead to Facebook. If you use any call tracking system it can do it so it's basically like an offline event that you're passing to Facebook)

- Billable calls (over 90 sec - we pass them as a Contact, but you can set up any name if you want to pass it)

Optimization Tip: Which event to choose when optimizing your campaign? We usually optimize for raw calls (connected calls), but we still track all the steps — clicks, 90-sec billable calls, 10-min calls, even enrollments. So, if you're asking “how to optimize pay-per-call campaigns for debt relief” — this is the model to start with.

Some people optimize for the 90-se calls (billable calls), others optimize for 10 minute duration calls, so it can be different for anyone.

Ad Metrics for Debt Settlement Campaigns

Here are the key ad metrics to keep in mind for debt settlement pay-per-call campaigns:1. CPM (Cost Per Thousand Impressions):

- Spanish debt: $20–$30 CPM

- English debt: $40–$60 CPM

2. CPC (Cost Per Click):

- Spanish debt: $0.80–$1.30 CPC

- English debt: $1.00–$1.50 CPC

Both English and Spanish ads typically see a CTR of 1.5%–2.5%.

When to Pause Your Ads or Ad Sets

A lot of affiliates ask, "When should I pause my ads or ad sets?" Here’s our rule of thumb:Raw Calls: When we spend $20–$30 on an ad set, we expect it to generate at least one raw call. If it doesn't generate any results, we pause the ad set.

Billable Calls: For billable calls, we expect to spend at least $100–$150 to generate one billable call. If no results are seen after reaching this spend, we also pause the ad set.

Tracking & Tech Stack (Don’t Skip This)

To run this offer right, you need proper call tracking software. No exceptions.You can use:

- Marketcall’s free call tracking

- External tools like Ringba or Retreaver

- You have a dynamical pool of numbers where each visitor gets a unique phone number

- You capture all the juicy data: FB click ID, IP, UTM tags

- You can pass it to your traffic tracker (ex. Keitaro, Redtrack) or other platforms via conversion API

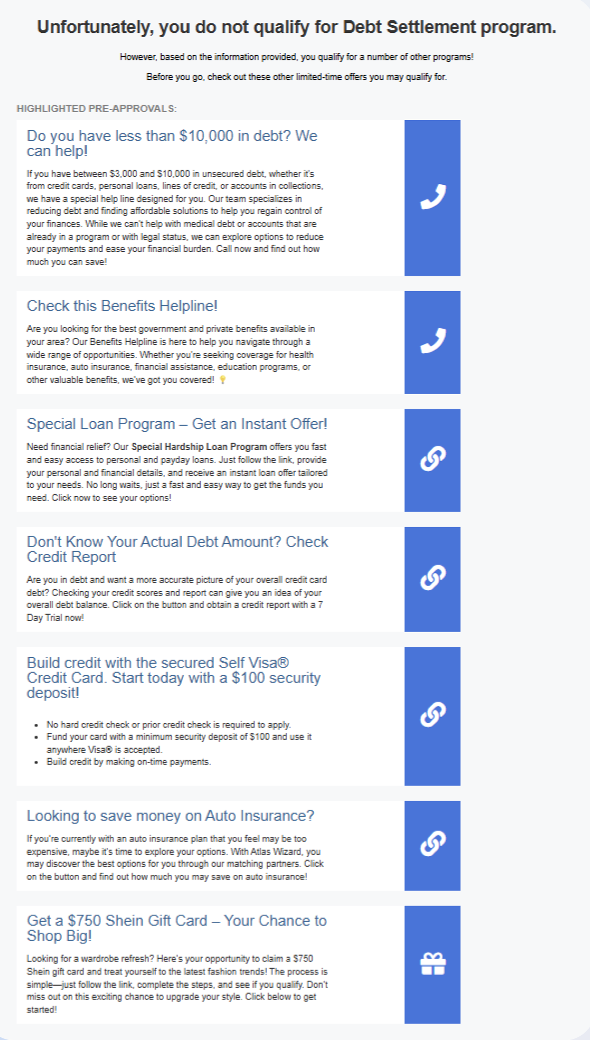

What About Unqualified Leads?

Not everyone will qualify (no surprise). But that doesn’t mean they’re useless.Here’s what you can do:

- Collect their lead info before redirecting them to the exit page (name, phone, email)

- Send them to an exit page with other offers like:

- Lower-tier debt relief offers

- Credit repair or monitoring

- Search feed with keywords like “debt” or “loans”

- Personal loans, ACA insurance, job offers, etc.