Graybeard

Well-Known Member

It's not only banks but stablecoin, payment processors and MTA (Money Transfer Agents) at risk.

You can look up your US FDIC banks' data here

Banks I do business with are solvent

Overall, bank delinquencies are down -10% Q4 2022

Precious metals may trigger Monday

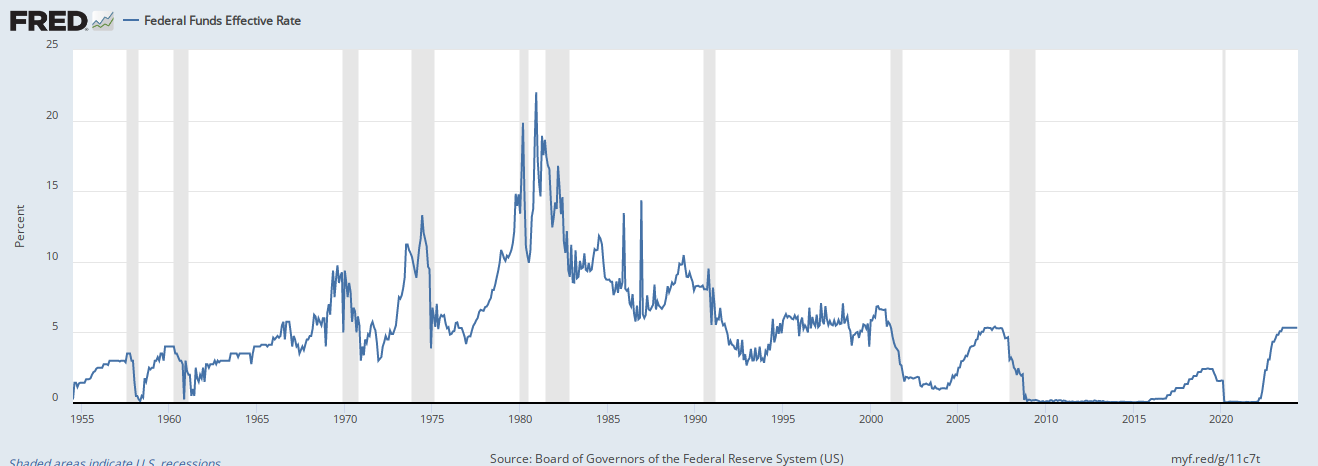

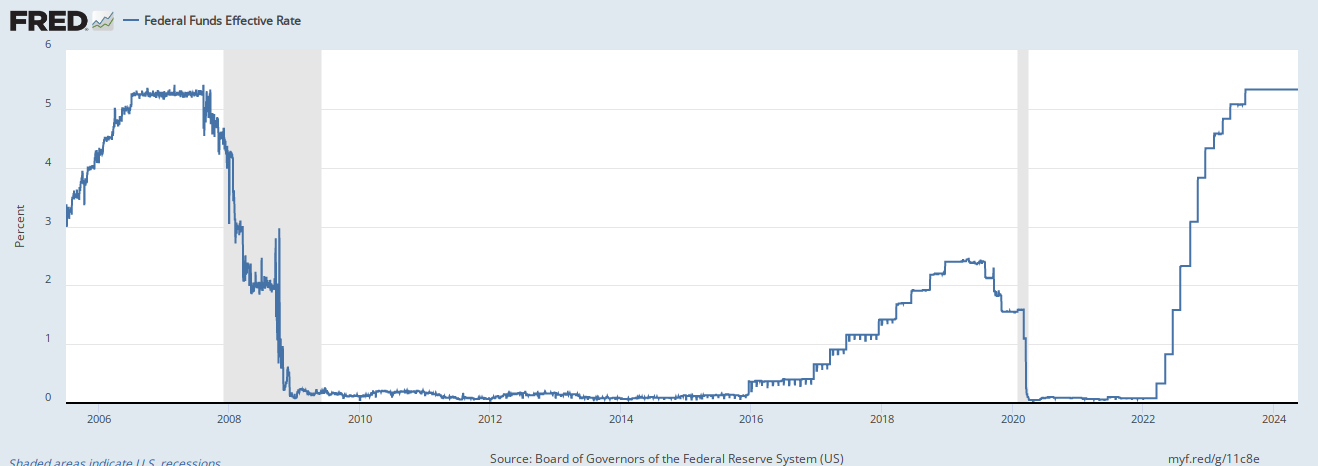

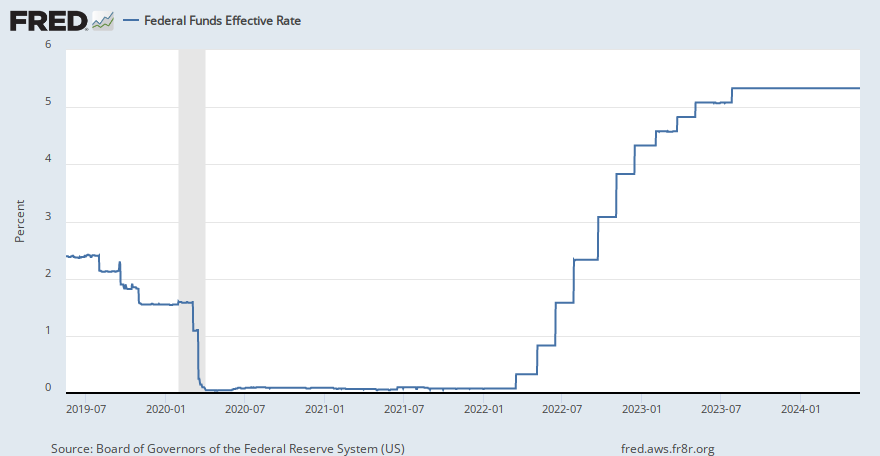

I blame Powell

Good luck to the winners ...

You can look up your US FDIC banks' data here

Banks I do business with are solvent

Overall, bank delinquencies are down -10% Q4 2022

Precious metals may trigger Monday

I blame Powell

Good luck to the winners ...

/cloudfront-us-east-2.images.arcpublishing.com/reuters/MWA3XHVYYBM6LFF2DQ6KY6JIKQ.jpg)